Most mortgage brokers are fighting over the same 3% of homebuyers who are ready to close next week.

Meanwhile, 93% of Gen Z still wants to own homes someday. But they’re not calling mom and dad for broker referrals anymore.

The referral networks that built careers over decades are fragmenting. Families are scattered. Gen Z homebuying patterns show they research independently, judge you by your Google reviews, and make decisions based on social proof rather than family recommendations.

This creates a fundamental problem. Every broker is chasing the same “now” buyers while ignoring the massive pipeline of future clients.

The Apple Tree Problem

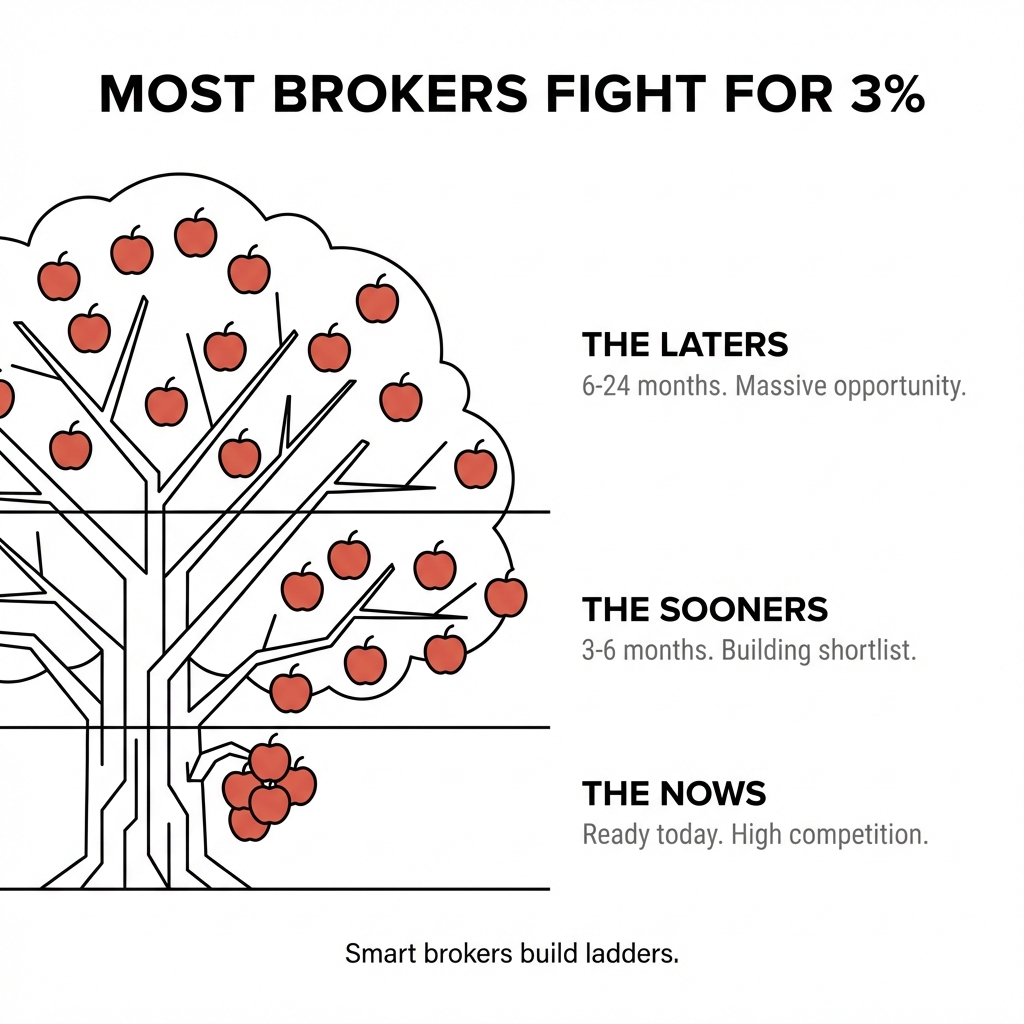

Think of your market like an apple tree.

Most brokers are jumping for the low-hanging fruit. The ready-to-buy-today clients on the bottom branches. Everyone sees those apples. Everyone fights for them.

But the real harvest is in the middle and top of the tree. The prospects who won’t buy for 6, 12, or 18 months. The ones doing early research, comparing options, building trust over time.

Smart brokers build ladders. They create systems to reach the entire tree.

The Nows, Sooners, Laters Framework

I break every prospect pipeline into three categories:

The Nows: Ready to buy immediately. Every broker fights over these. High competition, low margins, stressful closes.

The Sooners: Actively researching, comparing options. Timeline is 3-6 months. They’re building their short list.

The Laters: Early awareness stage. They know they want to buy someday but haven’t committed to a timeline. Could be 6-24 months out.

Most brokers only see the Nows. They spend all their marketing budget competing for immediate buyers.

The winning strategy captures all three categories. When your Laters become Sooners, and your Sooners become Nows, you’re already their trusted guide.

Why AI Changes Everything

The search behavior shift is happening faster than most brokers realize.

Traditional search behavior shift data shows search engine volume will drop 25% by 2026. Gen Z prospects are asking AI assistants questions instead of scrolling through broker websites.

This creates opportunity for brokers who adapt early.

AI-driven systems can handle the qualification and nurturing that used to require manual follow-up. AI automation benefits include 30-50% reduction in time spent on routine inquiries.

Your AI webchat captures the 11 PM question: “Can I afford a house with student loans?”

Your AI voice receptionist books qualification calls while you sleep.

Your automated email sequences keep you top-of-mind during the 18-month research process.

The Chickening Out Period

Here’s what most vendors won’t tell you: the first 12-14 weeks are rough.

You’ll feel upside down. You’ll question the investment. You’ll wonder if the old way was better.

I call this the chickening out period. Every broker goes through it.

The difference between success and failure is pushing through those first three months. That’s when the system starts learning, your rankings improve, and the pipeline begins filling with qualified prospects.

You’re not just building a marketing system. You’re building a competitive moat.

The Hockey Stick Reality

AI adoption follows a hockey stick curve. Slow at first, then exponential.

In the next 3-5 years, every serious mortgage broker will be using AI-driven marketing systems. The question is whether you’ll be early or late to the party.

Early adopters capture market share while competitors are still manually qualifying leads and chasing referrals from retired networks.

Late adopters find themselves competing against brokers who have 18-month head starts on pipeline development and client education.

Building Your Ladder

The winning brokers are already building unified AI systems that capture anonymous website visitors and nurture them through the entire buying journey.

They’re optimizing Google Business Profiles to show up in AI search summaries.

They’re creating content that educates Gen Z prospects about avoiding their parents’ financial mistakes.

They’re setting up automated review management and reputation systems.

Most importantly, they’re thinking in quarters instead of weeks. They’re playing the long game while competitors fight over scraps.

The mortgage industry is splitting into two groups: brokers who harvest the whole tree, and brokers who keep jumping for the same low-hanging fruit.

Which group will you choose?